Fixed Assets Blog

Paragon International to Participate in World-Leading Hotel Industry Event

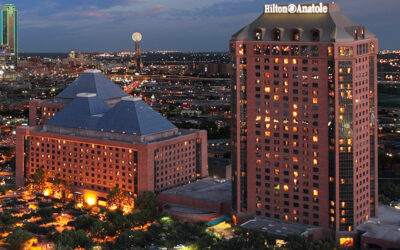

Hotel Buyers Can Meet with Paragon to Discuss Key Tax Reduction Strategies at The Lodging Conference This week Paragon International, a leading provider of Sage Fixed Asset Management Software, physical asset inventory services, fixed asset valuation, and cost...

Paragon International CEO Named Expert Moderator at Leading Real Estate Financing Conference in US

Paragon International CEO to Share Cutting-Edge Ideas for Maximizing Commercial Real Estate ROI This week Paragon International President & CEO, Rick Swarts, will be an expert moderator for a real estate financing session at the Crittenden Real Estate...

Alert! New Updates to the 179D Energy Tax Deduction

Big Changes Are Coming to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

The 3 Most Critical Valuation and Appraisal Tasks for Companies to Perform in the Next 24 Months

It's a Smart Idea to Reappraise or Revalue Your Assets within the Next 24 Months...Here's Why The next few months should be interesting in the business world. As we all emerge from the unprecedented global chaos of the last 24 months, companies across the world...

Why Mid-Sized and Large Companies Are Choosing Cloud Hosting for Sage Fixed Assets

Is Your Company at the Point Where Cloud Hosting for Sage Fixed Assets Simply Makes the Most Sense? Many mid-sized to large companies are facing an urgent need to provide secure, remote access to Sage Fixed Assets for multiple users – but simply thinking about...

How to Succeed with Tax Engineering – Cost Segregation for New Construction

Read About Cost Segregation for New Construction BEFORE Moving Forward with Your Project When your business is planning new construction, you have a lot of details to track. The process see-saws from grindingly slow to exhaustingly fast, which makes it likely you will...

Who Benefits from Fixed Asset Management Strategies?

Fixed Asset Management Can Improve Your Financial Efficiency – But Is It Right for You Nearly two-thirds of large enterprises are using fixed asset technologies as an integrated module to their ERP, and studies conducted by Aberdeen research firm show that...

Paragon to Host Partner Happy Hour at Sage Partner Summit 2022

Original Charter FAS Business Partner to Honor Entire Sage Partner Community Paragon International, Inc., a leading provider of Sage Fixed Asset Software, physical asset inventory services, fixed asset valuation, and cost reconciliation studies, announced that...

What Is Fixed Asset Depreciation?

Fixed Asset Depreciation Can Be a Headache or a Breeze – You Choose Fixed assets are company assets that have an expected useful life of more than one year, such as buildings, office equipment, or machinery. Over time, these items depreciate in value until they have...

4 Key Tax Strategies to Generate Cash Flow

The past few years have brought considerable changes to the tax codes. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Tax Cuts and Jobs Act (TCJA), and Energy Policy Act (EPACT) offer immense opportunities for companies to accelerate or increase...

Why Choose Paragon for Your Managed Sage Fixed Assets Cloud Hosting

It’s time. You’re ready to have your Sage Fixed Assets system in the cloud. You want a secure, managed Sage Fixed Assets cloud hosting solution that allows you to focus on your business. No more on-premises hassles. You need to access your Sage Fixed Assets from...

What’s New in Sage Fixed Assets 2022.1 – Tax Updates and Enhancements

The Sage Fixed Assets 2022.1 release includes important federal tax law compliance updates, useful enhancements and a few bug fixes. Beginning with the 2022.0 Release and continuing with this one, certain new features are available only with the subscription version....

Sage Fixed Assets is NOT Affected by Apache Log4j Vulnerability

The global cybersecurity community has been abuzz about the Apache Log4j vulnerability. It is widespread and affecting large companies, hospitals and our nation’s military. The Department of Homeland Security is calling it the most serious flaw in decades, and has...

Top 9 Cash Flow Planning Tips

It’s financial reporting and tax time. Do you want more write-offs to offset income? Are you struggling to get more cash flow? Are you mired too deeply in other activities to do something about this? Let us help you. Here are nine Cash Flow Planning Tips that are sure...

Maximize Bonus Depreciation and Increase Cash Flow – Before it Expires

In an effort to encourage commercial investment and stimulate the economy, the Tax Cuts and Jobs Act of 2017 (TCJA) and the Coronavirus Aid, Relief, Economic Security Act of 2020 (CARES Act), allow for additional and/or accelerated depreciation tax deductions. These...

What’s New in Sage Fixed Assets 2022.0 – New Features and Enhancements

The Sage Fixed Assets 2022.0 release contains a variety of new time-saving features and enhancements, some of which were suggestions by customers like you. You’ll notice that some of the new features are available only with the subscription version. As Sage encourages...