ParaCare Support

ParaCare from Paragon

With ParaCare, your team has the experts at Paragon available for:

Remote Assistance with Sage Fixed Assets Annual Upgrades

Remote Tech Support

Live Phone or E-mail Assistance for Questions About the Software, Reporting, and Depreciation

Windows or Android Scanner Assistance when Setting Up Inventories

Experiencing issues or have questions about Sage Fixed Assets?

Get the Latest Tax Insights from Paragon

IRS Guidelines

The Latest on 179D Energy Tax Deductions

Big Changes Occurred to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

Alert! New Updates to the 179D Energy Tax Deduction

Big Changes Are Coming to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

4 Key Tax Strategies to Generate Cash Flow

The past few years have brought considerable changes to the tax codes. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Tax Cuts and Jobs Act (TCJA), and Energy Policy Act (EPACT) offer immense opportunities for companies to accelerate or increase...

What’s New in Sage Fixed Assets 2022.1 – Tax Updates and Enhancements

The Sage Fixed Assets 2022.1 release includes important federal tax law compliance updates, useful enhancements and a few bug fixes. Beginning with the 2022.0 Release and continuing with this one, certain new features are available only with the subscription version....

Maximize Bonus Depreciation and Increase Cash Flow – Before it Expires

In an effort to encourage commercial investment and stimulate the economy, the Tax Cuts and Jobs Act of 2017 (TCJA) and the Coronavirus Aid, Relief, Economic Security Act of 2020 (CARES Act), allow for additional and/or accelerated depreciation tax deductions. These...

Tax Savings

The Latest on 179D Energy Tax Deductions

Big Changes Occurred to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

How and When to Test for Fixed Asset Impairment

Do You Suspect It May Be Time to Test for Fixed Asset Impairment? This Will Help. Fixed asset impairment occurs when an asset experiences a one-time or unexpected drop in value, resulting in a significantly lower market value than the one listed on your balance sheet....

What Is MACRS Depreciation?

Business Fixed Assets Are Subject to MACRS Depreciation. What Is That & How Does It Work? MACRS is an IRS structure required for calculating depreciation on assets. As you would expect from the IRS, the MACRS depreciation system is complex and it punishes...

How to Reduce Your Commercial Real Estate Transfer Tax Obligation

Here’s a Great Way Commercial Real Estate Investors Can Lower Their Real Estate Transfer Tax Burden The real estate transfer tax is levied when real property, including commercial real estate, changes hands. There are only about a dozen states that don’t have a...

How Much Can You Save? Use the Cost Segregation Savings Calculator and Find Out.

Add Up Your Savings on New or Past Projects with the Cost Segregation Savings Calculator As a real-estate investor or developer, you already have the innate ability to spot a great deal. However, you may not know the ins and outs of cost segregation, the tax strategy...

Cost Segregation

The Latest on 179D Energy Tax Deductions

Big Changes Occurred to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

The 7 Benefits of Cost Segregation Studies

Why Cost Segregation Matters to Your Business Tax Day has come and gone, and you’re probably already thinking of how to reduce your business’ tax obligation next year. Cost Segregation is a valuable, often overlooked, tax strategy that can increase cash flow...

Discover How to Save on Your Tax Bill This Year by Following This Cost Segregation Real Estate Example

Understand the Step-by-Step Process to Get Your Immediate Tax Refund with this Cost Segregation Real Estate Example Many commercial property owners are overpaying on their taxes each year. Perhaps even you. If you are looking for a way to recoup prior overpaid...

How Much Can You Save? Use the Cost Segregation Savings Calculator and Find Out.

Add Up Your Savings on New or Past Projects with the Cost Segregation Savings Calculator As a real-estate investor or developer, you already have the innate ability to spot a great deal. However, you may not know the ins and outs of cost segregation, the tax strategy...

Alert! New Updates to the 179D Energy Tax Deduction

Big Changes Are Coming to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

Tax FAQs

Depreciation Rules for Qualified Property Placed in Service on an Indian Reservation

Are there special depreciation rules for qualified property placed in service on an Indian reservation?

There are special rules that allow you to use shorter recovery periods to figure your depreciation deduction for qualified property placed in service on an Indian reservation after December 31, 2007, and by December 31, 2021 (Code Sec. 168(j)).

What is considered to be qualified property?

Property which is used predominately in the active conduct of a trade or business within an Indian Reservation and is 3-, 5-, 7-, 10-, 15-, and 20-year property and nonresidential real property is considered to be qualified property.

Real property you rent to others that is located on an Indian reservation is also eligible for the shorter recovery periods. (Code Sec. 168(j))

What property is not considered to be qualified property?

The following properties are not qualified property:

- Property used or located outside an Indian reservation on a regular basis. **

- Property acquired directly or indirectly from certain related persons.

- Property placed in service for purposes of conducting or housing certain gaming activities. Qualified property also does not include any property you must depreciate under the Alternative Depreciation System (ADS).

- Property placed in service after December 31, 2021 (Code Sec. 168(j)).

** Property in this category does not apply to qualified infrastructure property located outside the reservation that is used to connect with qualified infrastructure within the reservation.

Section 47: Rehabilitation Credit Certification Requirements

Under Section 47, the rehabilitation credit for any taxable year is the sum of 10% of the qualified rehabilitation expenditures with respect to any qualified rehabilitation building other than a certified historic structure, which is 20%. Qualified rehabilitation expenditures with respect to any qualified rehabilitated building shall be taken into account for the taxable year which such qualified rehabilitated building is placed in service.

Excerpts fromhttps://fixedassetexperts.com/paracare/ Section 47 are shown below (View the Complete Section 47 Text)

A “qualified rehabilitated building” means any building and its structural components that meet the following guidelines:

(I) 50 percent or more of the existing external walls of such building are retained in place as external walls,

(II) 75 percent or more of the existing external walls of such building are retained in place as internal or external walls, and

(III) 75 percent or more of the existing internal structural framework of such building is retained in place, and

(IV) Building must first be placed in service before 1936.

(3) CERTIFIED HISTORIC STRUCTURE DEFINED

(A) IN GENERAL

The term “certified historic structure” means any building (and its structural components) which–

(i) is listed in the National Register, or

(ii) is located in a registered historic district and is certified by the Secretary of the Interior to the Secretary as being of historic significance to the district.

(B) REGISTERED HISTORIC DISTRICT

The term “registered historic district” means–

(i) any district listed in the National Register, and

(ii) any district–

(I) which is designated under a statute of the appropriate State or local government, if such statute is certified by the Secretary of the Interior to the Secretary as containing criteria which will substantially achieve the purpose of preserving and rehabilitating buildings of historic significance to the district, and

(II) which is certified by the Secretary of the Interior to the Secretary as meeting substantially all of the requirements for the listing of districts in the National Register.

Several reports will be issued as a result of ongoing rehabilitation work planned over an extended period of time. It is our assumption that the taxpayer will elect the 60 month time period under Section 47 of the IRC.

Engineering Analysis and Certification

As specifically required by Section 47, we will conduct an engineering analysis of the rehabilitation work, plans, and cost records to:

- Measure the percentages of internal structural framework and external walls retained for compliance with paragraphs (c) (1) (A), (C), and (D).

- Identify component parts irrevocably devoted to use in the building as progress expenditures for compliance with paragraphs (d) (1) and (3) (A) (i) (ii).

- Estimate percentage of completion attributable to rehabilitation completed during the taxable years during the rehabilitation period under paragraph (d) (3) (D).

We will then issue a Section 47 Rehabilitation Credit Qualification Engineering Certification for each year of the rehabilitation period, attesting to all of the above requirements with the results of our measurements, analysis, and verification of client-furnished documents which in our opinion entitle the taxpayer to the 10% Rehabilitation or 20% Historic Structure Rehabilitation Credit.

Have questions about capturing these significant tax credits for your business? Contact the team at Paragon International today to discuss your specific situation.

Section 47: Rehabilitation Tax Credit Definition

(a) General rule

For purposes of section 47, the rehabilitation credit for any taxable year is the sum of—

(1) 10 percent of the qualified rehabilitation expenditures with respect to any qualified rehabilitated building other than a certified historic structure, and

(2) 20 percent of the qualified rehabilitation expenditures with respect to any certified historic structure.

(b) When expenditures taken into account

(1) In general

Qualified rehabilitation expenditures with respect to any qualified rehabilitated building shall be taken into account for the taxable year in which such qualified rehabilitated building is placed in service.

(2) Coordination with subsection (d)

The amount which would (but for this paragraph) be taken into account under paragraph (1) with respect to any qualified rehabilitated building shall be reduced (but not below zero) by any amount of qualified rehabilitation expenditures taken into account under subsection (d) by the taxpayer or a predecessor of the taxpayer (or, in the case of a sale and leaseback described in section 50 (a)(2)(C), by the lessee), to the extent any amount so taken into account has not been required to be recaptured under section 50 (a).

(c) Definitions

For purposes of this section—

(1) Qualified rehabilitated building

(A) In general

The term “qualified rehabilitated building” means any building (and its structural components) if—

(i) such building has been substantially rehabilitated,

(ii) such building was placed in service before the beginning of the rehabilitation,

(iii) in the case of any building other than a certified historic structure, in the rehabilitation process—

(I) 50 percent or more of the existing external walls of such building are retained in place as external walls,

(II) 75 percent or more of the existing external walls of such building are retained in place as internal or external walls, and

(III) 75 percent or more of the existing internal structural framework of such building is retained in place, and

(iv) depreciation (or amortization in lieu of depreciation) is allowable with respect to such building.

(B) Building must be first placed in service before 1936

In the case of a building other than a certified historic structure, a building shall not be a qualified rehabilitated building unless the building was first placed in service before 1936.

(C) Substantially rehabilitated defined

(i) In general For purposes of subparagraph (A)(i), a building shall be treated as having been substantially rehabilitated only if the qualified rehabilitation expenditures during the 24-month period selected by the taxpayer (at the time and in the manner prescribed by regulation) and ending with or within the taxable year exceed the greater of—

(I) the adjusted basis of such building (and its structural components), or

(II) $5,000.

The adjusted basis of the building (and its structural components) shall be determined as of the beginning of the 1st day of such 24-month period, or of the holding period of the building, whichever is later. For purposes of the preceding sentence, the determination of the beginning of the holding period shall be made without regard to any reconstruction by the taxpayer in connection with the rehabilitation.

(ii) Special rule for phased rehabilitation In the case of any rehabilitation which may reasonably be expected to be completed in phases set forth in architectural plans and specifications completed before the rehabilitation begins, clause (i) shall be applied by substituting “60-month period” for “24-month period”.

(iii) Lessees The Secretary shall prescribe by regulation rules for applying this subparagraph to lessees.

(D) Reconstruction

Rehabilitation includes reconstruction.

(2) Qualified rehabilitation expenditure defined

(A) In general

The term “qualified rehabilitation expenditure” means any amount properly chargeable to capital account—

(i) for property for which depreciation is allowable under section 168 and which is—

(I) nonresidential real property,

(II) residential rental property,

(III) real property which has a class life of more than 12.5 years, or

(IV) an addition or improvement to property described in subclause (I), (II), or (III), and

(ii) in connection with the rehabilitation of a qualified rehabilitated building.

(B) Certain expenditures not included

The term “qualified rehabilitation expenditure” does not include—

(i) Straight line depreciation must be used Any expenditure with respect to which the taxpayer does not use the straight line method over a recovery period determined under subsection (c) or (g) of section 168. The preceding sentence shall not apply to any expenditure to the extent the alternative depreciation system of section 168 (g) applies to such expenditure by reason of subparagraph (B) or (C) of section 168 (g)(1).

(ii) Cost of acquisition The cost of acquiring any building or interest therein.

(iii) Enlargements Any expenditure attributable to the enlargement of an existing building.

(iv) Certified historic structure, etc. Any expenditure attributable to the rehabilitation of a certified historic structure or a building in a registered historic district, unless the rehabilitation is a certified rehabilitation (within the meaning of subparagraph (C)). The preceding sentence shall not apply to a building in a registered historic district if—

(I) such building was not a certified historic structure,

(II) the Secretary of the Interior certified to the Secretary that such building is not of historic significance to the district, and

(III) if the certification referred to in subclause (II) occurs after the beginning of the rehabilitation of such building, the taxpayer certifies to the Secretary that, at the beginning of such rehabilitation, he in good faith was not aware of the requirements of subclause (II).

(v) Tax-exempt use property

(I) In general Any expenditure in connection with the rehabilitation of a building which is allocable to the portion of such property which is (or may reasonably be expected to be) tax-exempt use property (within the meaning of section 168 (h), except that “50 percent” shall be substituted for “35 percent” in paragraph (1)(B)(iii) thereof).

(II) Clause not to apply for purposes of paragraph (1)(C) This clause shall not apply for purposes of determining under paragraph (1)(C) whether a building has been substantially rehabilitated.

(vi) Expenditures of lessee Any expenditure of a lessee of a building if, on the date the rehabilitation is completed, the remaining term of the lease (determined without regard to any renewal periods) is less than the recovery period determined under section 168 (c).

(C) Certified rehabilitation

For purposes of subparagraph (B), the term “certified rehabilitation” means any rehabilitation of a certified historic structure which the Secretary of the Interior has certified to the Secretary as being consistent with the historic character of such property or the district in which such property is located.

(D) Nonresidential real property; residential rental property; class life

For purposes of subparagraph (A), the terms “nonresidential real property,” “residential rental property,” and “class life” have the respective meanings given such terms by section 168.

(3) Certified historic structure defined

(A) In general

The term “certified historic structure” means any building (and its structural components) which—

(i) is listed in the National Register, or

(ii) is located in a registered historic district and is certified by the Secretary of the Interior to the Secretary as being of historic significance to the district.

(B) Registered historic district

The term “registered historic district” means—

(i) any district listed in the National Register, and

(ii) any district—

(I) which is designated under a statute of the appropriate State or local government, if such statute is certified by the Secretary of the Interior to the Secretary as containing criteria which will substantially achieve the purpose of preserving and rehabilitating buildings of historic significance to the district, and

(II) which is certified by the Secretary of the Interior to the Secretary as meeting substantially all of the requirements for the listing of districts in the National Register.

(d) Progress expenditures

(1) In general

In the case of any building to which this subsection applies, except as provided in paragraph (3)—

(A) if such building is self-rehabilitated property, any qualified rehabilitation expenditure with respect to such building shall be taken into account for the taxable year for which such expenditure is properly chargeable to capital account with respect to such building, and

(B) if such building is not self-rehabilitated property, any qualified rehabilitation expenditure with respect to such building shall be taken into account for the taxable year in which paid.

(2) Property to which subsection applies

(A) In general

This subsection shall apply to any building which is being rehabilitated by or for the taxpayer if—

(i) the normal rehabilitation period for such building is 2 years or more, and

(ii) it is reasonable to expect that such building will be a qualified rehabilitated building in the hands of the taxpayer when it is placed in service.

Clauses (i) and (ii) shall be applied on the basis of facts known as of the close of the taxable year of the taxpayer in which the rehabilitation begins (or, if later, at the close of the first taxable year to which an election under this subsection applies).

(B) Normal rehabilitation period

For purposes of subparagraph (A), the term “normal rehabilitation period” means the period reasonably expected to be required for the rehabilitation of the building—

(i) beginning with the date on which physical work on the rehabilitation begins (or, if later, the first day of the first taxable year to which an election under this subsection applies), and

(ii) ending on the date on which it is expected that the property will be available for placing in service.

(3) Special rules for applying paragraph (1)

For purposes of paragraph (1)—

(A) Component parts, etc.

Property which is to be a component part of, or is otherwise to be included in, any building to which this subsection applies shall be taken into account—

(i) at a time not earlier than the time at which it becomes irrevocably devoted to use in the building, and

(ii) as if (at the time referred to in clause (i)) the taxpayer had expended an amount equal to that portion of the cost to the taxpayer of such component or other property which, for purposes of this subpart, is properly chargeable (during such taxable year) to capital account with respect to such building.

(B) Certain borrowing disregarded

Any amount borrowed directly or indirectly by the taxpayer from the person rehabilitating the property for him shall not be treated as an amount expended for such rehabilitation.

(C) Limitation for buildings which are not self-rehabilitated

(i) In general In the case of a building which is not self-rehabilitated, the amount taken into account under paragraph (1)(B) for any taxable year shall not exceed the amount which represents the portion of the overall cost to the taxpayer of the rehabilitation which is properly attributable to the portion of the rehabilitation which is completed during such taxable year.

(ii) Carryover of certain amounts In the case of a building which is not a self-rehabilitated building, if for the taxable year—

(I) the amount which (but for clause (i)) would have been taken into account under paragraph (1)(B) exceeds the limitation of clause (i), then the amount of such excess shall be taken into account under paragraph (1)(B) for the succeeding taxable year, or

(II) the limitation of clause (i) exceeds the amount taken into account under paragraph (1)(B), then the amount of such excess shall increase the limitation of clause (i) for the succeeding taxable year.

(D) Determination of percentage of completion

The determination under subparagraph (C)(i) of the portion of the overall cost to the taxpayer of the rehabilitation which is properly attributable to rehabilitation completed during any taxable year shall be made, under regulations prescribed by the Secretary, on the basis of engineering or architectural estimates or on the basis of cost accounting records. Unless the taxpayer establishes otherwise by clear and convincing evidence, the rehabilitation shall be deemed to be completed not more rapidly than ratably over the normal rehabilitation period.

(E) No progress expenditures for certain prior periods

No qualified rehabilitation expenditures shall be taken into account under this subsection for any period before the first day of the first taxable year to which an election under this subsection applies.

(F) No progress expenditures for property for year it is placed in service, etc.

In the case of any building, no qualified rehabilitation expenditures shall be taken into account under this subsection for the earlier of—

(i) the taxable year in which the building is placed in service, or

(ii) the first taxable year for which recapture is required under section 50 (a)(2) with respect to such property,

or for any taxable year thereafter.

(4) Self-rehabilitated building

For purposes of this subsection, the term “self-rehabilitated building” means any building if it is reasonable to believe that more than half of the qualified rehabilitation expenditures for such building will be made directly by the taxpayer.

(5) Election

This subsection shall apply to any taxpayer only if such taxpayer has made an election under this paragraph. Such an election shall apply to the taxable year for which made and all subsequent taxable years. Such an election, once made, may be revoked only with the consent of the Secretary.

Have questions about capturing these significant tax credits for your business? Contact the team at Paragon International today to discuss your specific situation.

Tangible Property Regulations TD9689 & Revenue Procedure 2014-54

It appears these were replacements of parts to keep the property in efficient operating condition or incidental repair and maintenance.

Excerpt from CCH explanation of TD9689 and Paragon Comment:

ROUTINE MAINTENANCE SAFE HARBOR

Key changes made by the final repair regulations with respect to the routine maintenance safe harbor include:

- Expansion of the routine maintenance safe harbor to include buildings

- Exclusion of network assets from the safe harbor.

The costs of performing certain routine maintenance activities on a unit of property, including a building structure or one of the enumerated building systems, are deductible under a routine maintenance safe harbor (Reg. §1.263(a)-3(i)). This safe harbor is not elective.

Under the safe harbor, an amount paid is deductible if it is for ongoing activities that, as a result of the taxpayer’s use of the unit of property, the taxpayer expects to perform to keep the unit of property in its ordinarily efficient operating condition. In the case of a building, the building structure and each building system is treated as a separate unit of property. – Paragon Comment: For example, in the case of the windows for buildings, replacement was necessary to keep the building in ordinary efficient operating condition for the ongoing business and its occupants. Capitalizing that cost before the final regulations were issued was appropriate per prior practices. But after Revenue Procedure 2014-54 and in the future, that cost qualifies for reclassification as a repair expense.

IMPACT

The maintenance must be attributable to the taxpayer’s use of the property. Thus, the safe harbor does not apply to scheduled maintenance performed shortly after purchasing a used machine or an existing building.

Accounting method changes.

The routine maintenance safe harbor is considered an accounting method and requires a full Code Sec. 481(a) adjustment (i.e., it is not a “paid or incurred” method applied on a cut-off basis). To change to the safe harbor method provided in the final regulations under Rev. Proc. 2014-16, a taxpayer files Form 3115 using change code 184.

Additionally, here is language from the IRS that defines capital vs. repair:

Excerpt From IRS Audit Guide

http://www.irs.gov/Businesses/Capitalization-v-Repairs-Audit-Technique-Guide#8

The following table summarizes many of the factual considerations considered by the courts. These factors, although not exhaustive, should be considered in your analysis to distinguish between capital expenditures and deductible repairs.

| Capital | Repair |

| Improvements that “put” property in a better operating condition | Improvements that “keep” property in efficient operating condition |

| Restores the property to a “like new” condition | Restores the property to its previous condition |

| Addition of new or replacement components or material sub-components to property | Protects the underlying property through routine maintenance |

| Addition of upgrades or modifications to property | Incidental Repair to property |

| Enhances the value of the property in the nature of a betterment | |

| Extends the useful life of the property | |

| Improves the efficiency of the property | |

| Improves the quality of the property | |

| Increases the strength of the property | |

| Increases the capacity of the property | |

| Ameliorates a material condition or defect | |

| Adapts the property to a new use | |

| Plan of Rehabilitation Doctrine |

Have questions about the difference between capital costs and repair expenses? Contact the team at Paragon International today to discuss your specific situation.

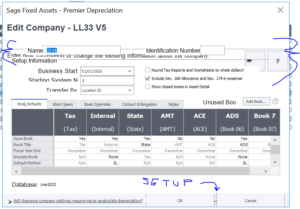

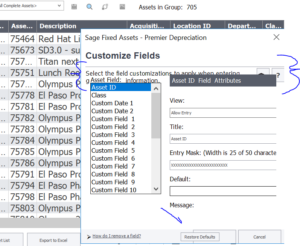

Sage Fixed Assets FAQs

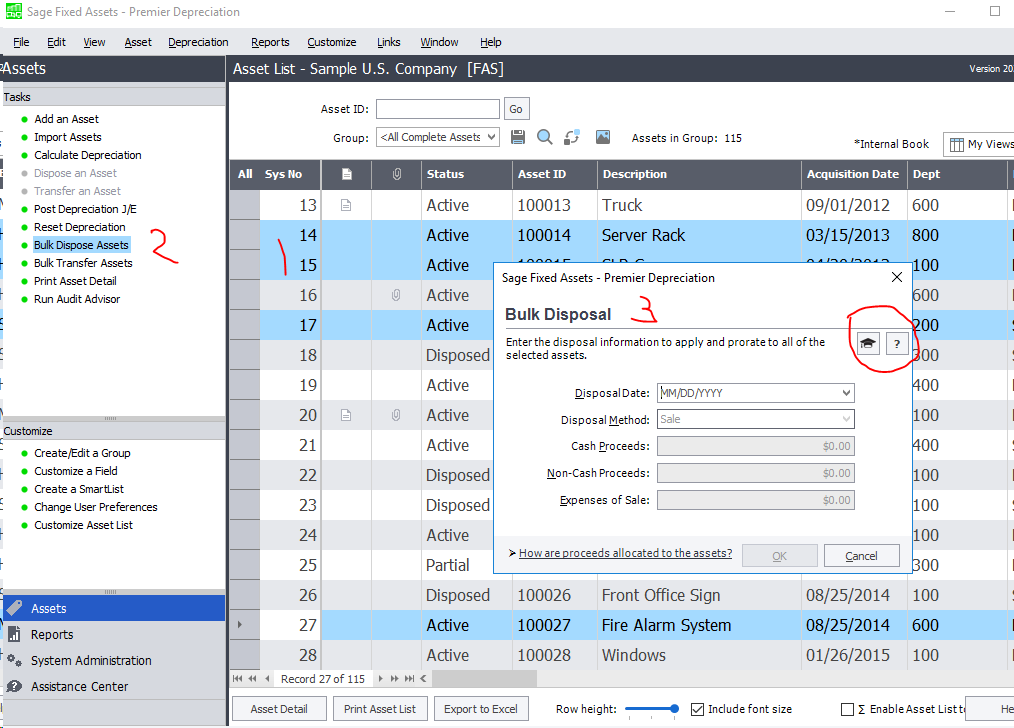

Bulk Disposals in Sage Fixed Assets

Sage Fixed Assets has a bulk disposal feature in the perpetual and subscription application. This feature allows you to dispose of assets as a group in bulk. You can use this feature, along with import disposals, to roll forward activity.

Here’s how to get started:

- Select asset rows with ctrl-click or shift-click like Excel

- Choose bulk dispose assets

- Fill in the dialog box and click ok

Have more questions about managing your fixed assets? Contact the team at Paragon today to discuss

your specific situation.

Can I Change the Useful Life of One or More Recorded Assets in Sage Fixed Assets?

Yes, Sage Fixed Assets allows you to change the useful life of one or more assets after they have been recorded in the system. You first change it by book then define when the change should be reflected on dialogs. It also allows you to define an earlier thru date if you calculate depreciation back to an older date or to the following month.

You can also use the Depreciation > Bulk Edit menu command to modify multiple fixed assets in one procedure.

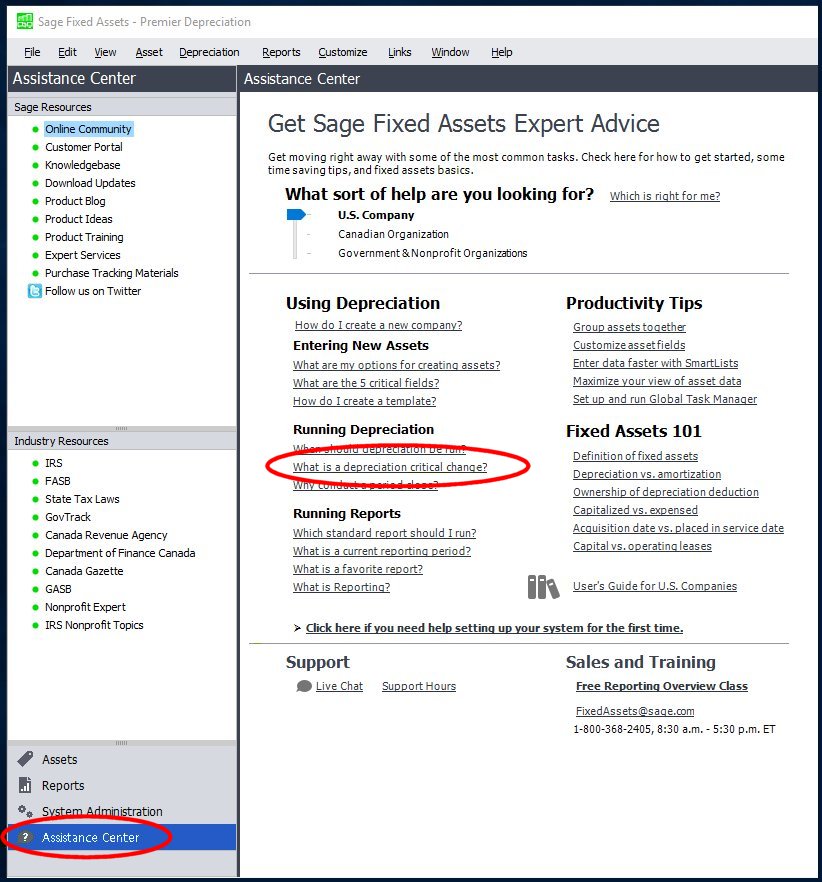

You can find step-by-step instructions in the Sage Fixed Assets Assistance Center (see below).

Have more questions about managing your fixed assets? Contact the team at Paragon today to discuss your specific situation.

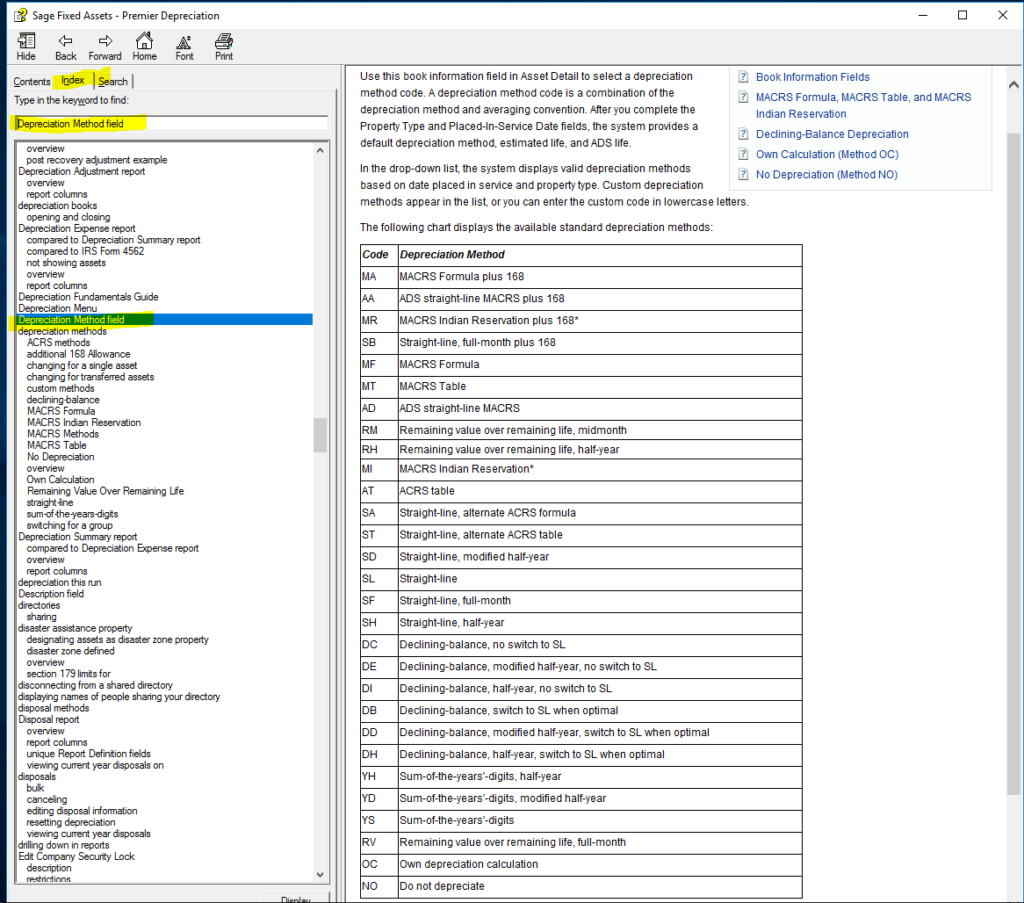

How Can I View the Definition of a Depreciation Method in Sage Fixed Assets?

The Sage Fixed Assets online Help provides a detailed overview about each depreciation method.

When in Sage Fixed Assets, select Help > Help Topics > US. When the online Help opens, enter Depreciation method field. The topic that opens (towards the right) includes detailed information about each depreciation method available in the system.

Have more questions about managing your fixed assets? Contact the team at Paragon today to discuss your specific situation.

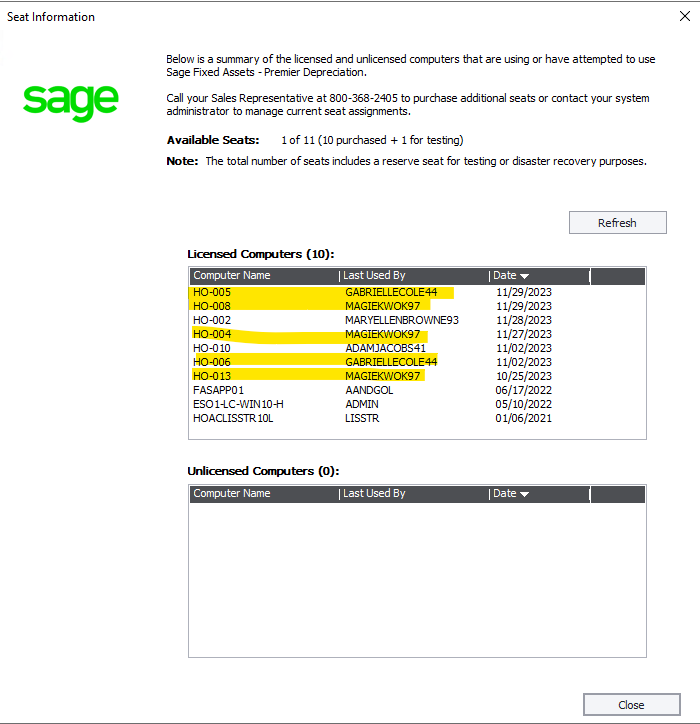

Ghost Users in Sage Fixed Asset

If you are having issues getting into Sage Fixed Assets, this could be caused by users not exiting the

solution using File |Exit from the menu.

Often users “X” out of a window or just shut down their computer with Sage Fixed Assets open, which

causes the licenses not to be released at the server. Eventually they get locked out and can’t open the

application, because the server thinks all the user licenses are being used.

It can also be by accessing remote desktop with VPN and not closing out correctly (note: connect via

VPN is unsupported).

To correct this, you need to access Sage Fixed Assets as the administrator and remove the ghost users

following the process below.

To view and deactivate licensed computers:

- For Network products, on the server, go to: Start, Programs, Sage Fixed Assets, Tools, Database Utility – Network Depreciation & Tracking, click Registration

- For Premier products, on the server, go to: Start, Programs, Sage Fixed Assets, Tools, Registration – Premier Depreciation & Tracking, click Registration

Note: If you are unable to find the Sage Fixed Assets program group in Windows Explorer:

- For Network: Go to C:\SFAServ\Network Clients\100BSNETREG.EXE

- For Premier: Go to C:\SFAServ\Premier Client\500BSNETREG.EXE

- Select the product and click Manage Seats.

- From Show Licensed Computers, select the checkbox for the computers to deactivate and click Deactivate.

Notes:

- Only a limited number of deactivations are allowed. If you select multiple computers to deactivate, each computer counts against the Remaining Deactivations

- When the Remaining Deactivations is zero, contact Live Chat below and request a deactivation reset code

- To use a code, click on Reset button, enter the reset code, click Reset and the Remaining Deactivations will return to the maximum allowed

To activate users:

- If the user has launched and connected Depreciation, their machine will show in Seat Management under Show Unlicensed Users. Select the machine and click Activate to manually activate

- If there is an available seat, new connections to the server will take a seat automatically

To view which computers/users have access to the product from a client workstation:

- Go to Help, Registration, highlight the product and click on View Seats. The Seat Information dialog will display the total number of client connections allowed. You cannot remove or add machines from the client program.

- Licensed Computers: lists the first computers to connect to the server. There will be no apparent change in the client connection until number of clients which connect exceeds your Available Seats + 1

- Unlicensed Computers: lists all other computers to connect to the server after the number of clients connected exceeds your Available Seats + 1

Ghost users are an issue that can be eliminated by hosting Sage Fixed Assets with Paragon Cloud SFA.

Have more questions about managing your fixed assets? Contact the team at Paragon today to discuss

your specific situation.

Setting up and Conducting an Inventory with the Sage Fixed Asset Scanner App

Note: This article assumes that the Sage Fixed Asset Scanner app is currently installed on the device you will be using. See How to install the Sage Fixed Assets Scanner for more details. Also a Microsoft OneDrive account is require to prepare a Mobile device reader. If the one who prepared the inventory is not the one scanning assets, the preparer will need to share the default inventory folder in Microsoft OneDrive with the other person (or people) assuming both have the same type of Microsoft OneDrive, business or personal, account.

In Sage Fixed Assets – Tracking:

Setup a Reader

- If a reader has not been configured: Click Inventory menu and select Reader Manager

- Enter a Reader Name and click Add.

- select Mobile Device for Reader Type for the Sage Fixed Assets Scanner app, and enter the Collector

- Optional: Click the Notes tab to enter additional information

- Click OK

To access the Inventory Helper dialog use one of the following:

- On the bottom left in the Tasks Navigation pane, click Inventory, select an empty row under Inventory Name and click Define/Edit Inventory

- Go to View menu, click Inventory, select an empty row under Inventory Name and click Define/Edit Inventory

- Go to the Inventory menu and click Inventory Helper

Create an Inventory

- In the Inventory Helper dialog: Click Next, provide an Inventory Name, Step Owner, choose between Baseline and Dynamic Inventory and click Next

- Baseline Inventory is intended for the collection of new asset. On clicking Next above: Levels fields will need to be selected. The tracking level fields are designed to hold information that remains constant for all assets collected during the inventory

- Dynamic Inventory is for the finding, editing or adding of asset. On clicking Next above: Choose the group that the inventory will be performed

- Select the Asset Fields to be included in the Inventory

- Optional: Click Save List to save the Inventory Field list for future reference

- Optional: Click Load List to use an existing Inventory Field List

- Once this process is complete, click Next

- Click Finish on the Summary Screen to finalize all choices and you will be prompted to prepare a readerNote: At this point the Inventory can be edited but once a reader has been prepared the Inventory can no longer be edited

Prepare the Reader

- Click Yes when prompted or click Prepare Reader on the Inventory dialog

- Choose the Reader to be used in the Inventory from the dropdown and click Prepare

- Verify information in the Prepare Reader – Summary window: The number of asset in the chosen group to be downloaded to the reader and click OK

- You will be prompted to login to your Microsoft OneDrive account

- Once the login process is complete, click OK on the Transfer Successful dialog and the reader name will now appear in the Prepared Readers section

- If no other readers need to be Prepared, click OK on the Prepare Reader dialog

Downloading the Inventory to the device and Scanning Assets:

On the mobile device:

- Open the Sage Fixed Assets Scanner app on your Android device, select to Download Inventory (a downward pointing arrow), login to your Microsoft OneDrive account, select and download the prepared inventory

- In the Sage Fixed Assets Scanner app and select the desired InventoryNote: It is possible to have multiple Inventories in progress at once on the mobile device

- Baseline Inventory:

- On opening a Baseline inventory you will be prompted to enter values for the Level fields selected during the inventory setup

- Hit the back arrow to start scanning assets by selecting the barcode icon in the upper right to activate the camera to scan a bar code and then fill in the asset information

- You can manually add an asset by selecting the three vertical dots and select Add Assets and fill in the asset information

- Select Save (the check mark in the upper right or Save button at the bottom of the asset fields) before returning to the asset list

- Dynamic inventory

- Once the Inventory is open on the mobile device all the assets included the inventory will be listed, you can then:

- Scan an existing barcode: Hit the barcode icon in the upper right to active the camera to scan a bar code

- If the scanned barcode is found: The asset’s details will populate and can be edited (which will be assets with changes) or just Saved (Found asset)

- If the scanned barcode is not found: The Mobile scanner will prompt to create a new asset, hitting Yes will open the Add Asset dialog with the tag field populated with the scanned barcode information and all other fields will be blank Enter the desire information into the fields and click Save

- Open an asset on the list and edit it manually

- You can manually add an asset by selecting the three vertical dots and selecting Add Assets and then fill in the asset information

- Scan an existing barcode: Hit the barcode icon in the upper right to active the camera to scan a bar code

- Select Save (the check mark in the upper right or Save button at the bottom of the asset fields) before returning to the asset list

- Once the Inventory is open on the mobile device all the assets included the inventory will be listed, you can then:

- Continue scanning until all assets involved in the inventory have been scanned prior to uploading. In the Scanner app there is a summary row below the search box listing the number of New, Found and Not Found assets in the inventory

- Once complete, hit the back arrow to return to the Inventory List

Uploading the inventory from the Scanner app:

- From the Inventory List, hit the up arrow to upload the Inventory to your Microsoft OneDrive account. You may need to log in again.

Receiving Data from the reader

- In Tracking in the Inventory Process area: (View, Inventory) click Receive Reader Data, choose reader from the dropdown and click Receive and click OK on the Records Received prompt

- If all readers prepared for this inventory has been received, you will be prompted to begin the reconciliation process. If you are sure you all assets involved have been scanned, click Yes and move to Reconciliation below. If not click No

- If no was clicked the Collected Data and Exceptions Reports can be used to verify which assets have been scanned and the Readers can be Prepare again to continue scanning. These Reports can be run from under the Reports Menu.Note: On Preparing a reader for the second time, the inventory in the Scanner app will appear as it did the first time the inventory was prepare. No data will be lost. Scan the specfic assets which were missing and recvie the data again

- Once you are sure all assets involved have been scanned, proceed to Reconciliation

Reconciliation

- Click Begin Reconciliation, enter the name of the Step Owner, and click OK

- Choose an Exception status from the dropdown box:

- Asset not found – Assets which were included in the Inventory Group but were not Scanned and Save in the Scanner app during the inventory process

- Asset with changes – Assets which were scanned, modified and saved during the Inventory. Addtional changes can be made in this dialog

- New Assets – Assets not currently in the system which were scanned and saved

- Assets with no changes – Assets which are scanned and saved during the inventoryApply the appropriate Reconciliation Option to the records for each Exception type:Note: The default Reconciliation Option is to not do the action appropriate for the Exception type.

Note: The Reconciliation can be paused at any time by clicking the Close button on the reconciliation dialog and answering Yes when prompted.

- Click Complete Reconciliation when finished: Click Yes on the prompt to confirm.

- Click Yes to run the Reconciliation Report, if desired.

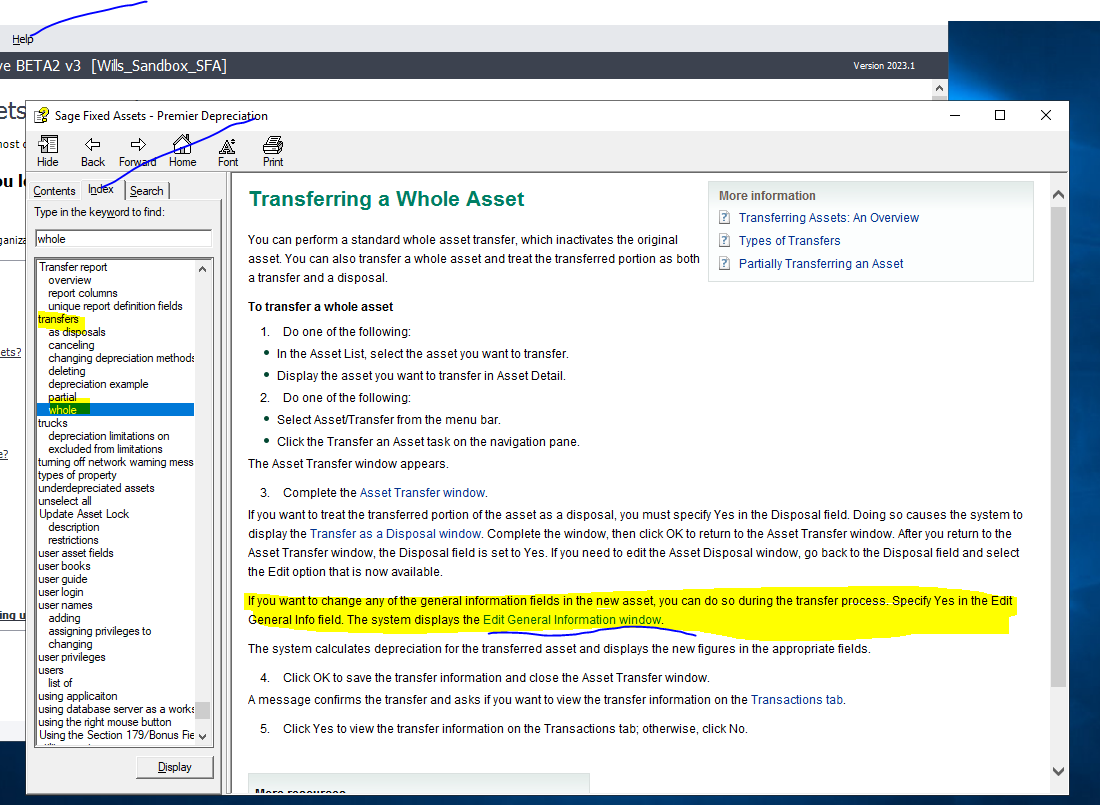

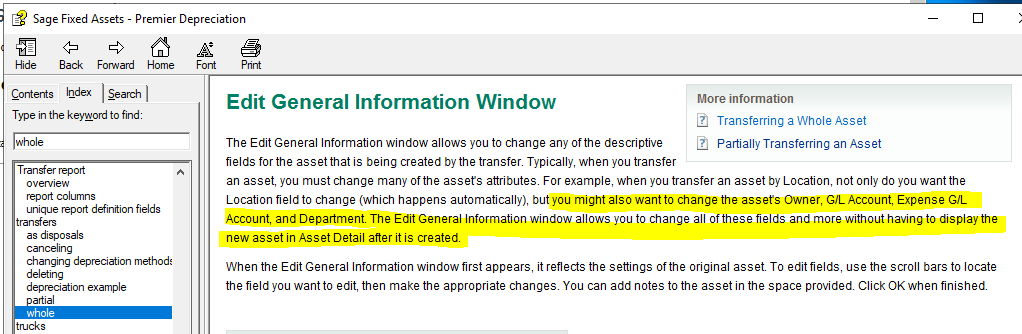

Transferring GL Expense Accounts in Sage Fixed Assets

If you are trying to clean up fixed assets that have been moved around or put to depreciation incorrectly, and you need to change the depreciation expense account (not historically but just as a particular date), then follow the following procedure.

How to Transfer a GL Expense Account

- Go to Menu | Help | Topics — and then search the Index for Transfers.

- See the Whole Transfer window, where you will find a link to how to use the Edit General Information Window, where you would update GL accounts on new assets but NOT on the original asset.

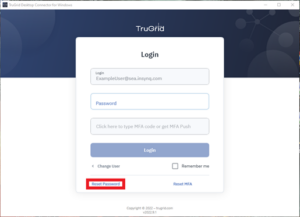

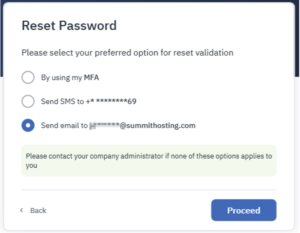

TruGrid Hosting Password Reset for Hosted Sage Fixed Assets

1. Open your preferred TruGrid Connector

2. Click “Reset Password”

3. Pick your preferred authentication method:

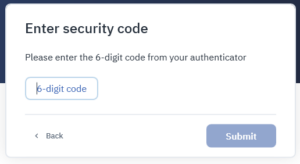

- If you choose “By using my MFA” you will receive this screen which you can use the push notification or manually enter the code from the phone application:

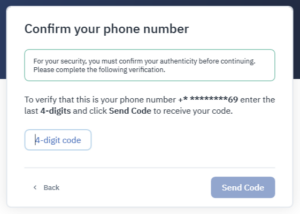

- If you choose “Send SMS to +*****” you will receive this screen where you will need to enter the 4-digit code from the text message sent to you:

- If you choose “Send email to email address” you will receive an email within a few minutes with a link you will need to click.

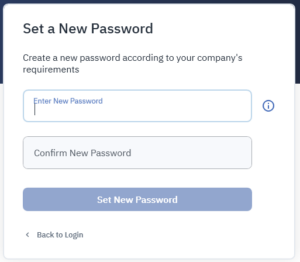

4. Once you complete the authentication step you will be presented with this screen to enter your new password:

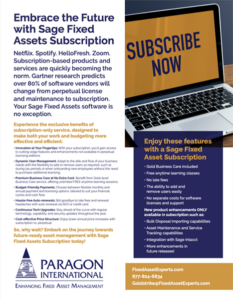

Why Switch to Sage Fixed Assets Subscription

Experience the exclusive benefits of subscription-only service, designed to make both your work and budgeting more effective and efficient:

- Innovation at Your Fingertips: With your subscription, you’ll gain access to cutting-edge features and enhancements not available in perpetual licensing editions.

- Dynamic User Management: Adapt to the ebb and flow of your business needs with the flexibility to add or remove users as required, such as during tax periods or when onboarding new employees without the need to purchase additional licensing.

- Premium Business Care at No Extra Cost: Benefit from Gold-level Business Care service, offering unlimited FREE anytime learning sessions.

- Budget-Friendly Payments: Choose between flexible monthly and annual payment and licensing options, tailored to suit your financial cycles and cash flow.

- Hassle-free Auto-renewals: Bid goodbye to late fees and renewal headaches with auto-renewal via ACH or credit card.

- Continuous Tech Upgrades: Stay ahead of the curve with regular technology, capability, and security updates throughout the year.

- Cost-effective Price Structure: Enjoy lower annual price increases with subscription vs. perpetual.

Learn more about future-ready asset management with Sage Fixed Assets Subscription today!

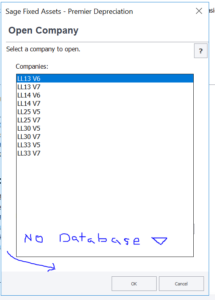

Windows Scaling Issues in Sage Fixed Assets Depreciation

In Sage Fixed Assets Depreciation, if you are experiencing:

- Transaction screens cut off

- Display overlap

- Text overlap

- Truncated text (text cut off)

- Field overlap

- Asset transfer window cut off

- Missing Smartlist manager

- Trouble scaling on a remote desktop connection

- Windows 10 display scaling issues

- Missing database list

- Asset detail, font size, or row height too small, or the

- Inventory screen appears broken…

… then a quick workaround is to:

- Set your local PC monitor to 100% scaling and no Font enlarging. Especially if you have two screens.

- Connect to your remote SFA system and all will look normal.

For a more thorough discussion, visit the Sage Knowlegebase article.

Cloud Hosting FAQs

Hosted Sage Fixed Assets Server Backup

Welcome to our comprehensive FAQ, designed to address your key questions about our data backup and restoration services. In this guide, you’ll find detailed information about our backup policies, procedures, and capabilities. Whether you’re concerned about the retention period of backups, the frequency of data backup, or the specifics of performing a restore, we’ve got you covered. Learn how to ensure your data is securely backed up and readily restorable when you need it.

Welcome to our comprehensive FAQ, designed to address your key questions about our data backup and restoration services. In this guide, you’ll find detailed information about our backup policies, procedures, and capabilities. Whether you’re concerned about the retention period of backups, the frequency of data backup, or the specifics of performing a restore, we’ve got you covered. Learn how to ensure your data is securely backed up and readily restorable when you need it.

Sage Support Resources

Sage Knowledgebase

The Sage Knowledgebase provides a searchable library of product related technical and procedural resources.

Sage City

Build meaningful connections, learn more about Sage Fixed Assets, and share your Sage Fixed Assets knowledge with connections.

Sage University

Explore a variety of learning resources that can help you get the most from your Sage Fixed Assets investment.

Sage Year-End Center

Find FAQs, Checklists, and other resources to asset with your annual year-end procedures.

Sage Fixed Assets Downloads

Find the latest Sage Fixed Assets software and product updates for download.

Sage Fixed Assets Documentation

Explore the library of Sage Fixed Assets documentation by version number.

Help Us Improve in Beta! Share Your Suggestions

This page is in “beta”, meaning we are still adding features to it. As such, your feedback is essential in helping us enhance both the page and our services. Whether you have ideas for improvements, feature requests, or any other comments, we welcome your input. Please use the form to submit your suggestions, and our team will carefully review and consider them. Thank you for being a part of our journey to make our services even better!

Ready to Experience the ParaCare Difference?

Contact the team at Paragon International today and find out how your business can experience the ParaCare Support difference.