Sage Intacct Integration, an AI Chatbot, and Faster QIP Property Entry Make Sage Fixed Assets 2024.1 the Best Version Yet

Great news: Sage Fixed Assets 2024.1 is available right now. In addition to the exciting updates we discussed in this blog about version 2024.0, the 2024.1 version includes all the yearly tax updates you need. It also includes great, new enhancements that were inspired by your feedback.

You can view all the updates, fixes, and important information in the Release Notes. If you would like to learn about the most important new additions, keep on reading.

Important Updates from the Latest Version of Sage Fixed Assets

Key additions to this version of Sage Fixed Assets include:

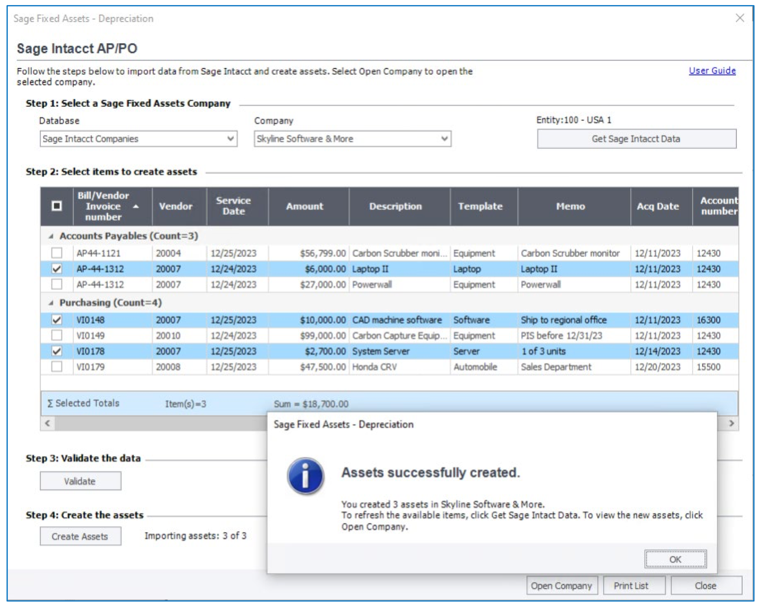

1. Sage Intacct Purchasing Module Integration (Subscription Only)

With Sage Fixed Assets 2024.1, it’s easy for Sage Intacct users to create assets in Sage Fixed Assets directly from their Purchasing module. After creating your asset, you can open and view the asset’s related Vendor Invoice in Sage Intacct by clicking the link in Sage Fixed Assets – Depreciation Asset Detail.

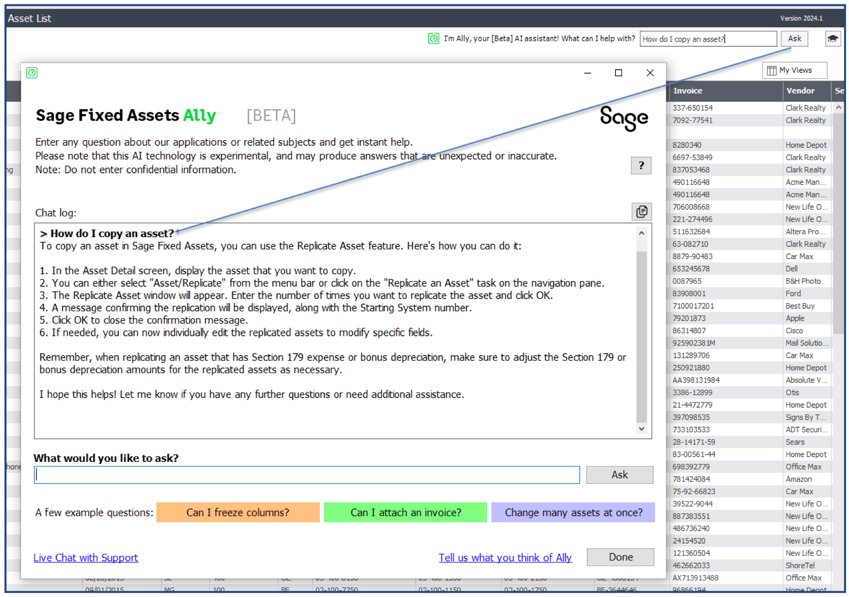

2. Sage Fixed Assets Ally (Subscription Only)

Meet Ally, the Sage Fixed Assets 2024.1 AI chatbot. Whenever you have a question about your Sage Fixed Assets solution, you can choose to have Ally answer it for you.

Sage Fixed Assets 2024 Ally is conveniently located at the top of your Asset List, so you always have help at your fingertips any time you need it.

3. Faster Entry for QIP Property

Under current U.S. tax law, Qualified Improvement Property (QIP) has a 15-year recovery period for the General Depreciation System (GDS) and a 20-year recovery period for the Alternative Depreciation System (ADS).

To save you time when entering QIP, Sage Fixed Assets 2024.1 now defaults to an estimated life of 15 years if the Depreciation Method MA100 (MACRS straight-line plus 168/bonus) is selected and 20 years if the Depreciation Method AA (ADS straight-line plus 168/bonus) is selected.

4. What about the Upcoming Tax Law Changes?

Sage can’t control Congress, but they can find ways to make change as painless as possible for you. If Congress enacts the law (H.R. 7024), Sage will provide an update to the 2024.1 tax release soon afterward.

On January 31, the U.S. House of Representatives passed H.R. 7024. The bill’s fate is uncertain in the Senate, where 60 votes are needed for passage, and opposition has emerged. With the Senate on recess from February 10 to 25, discussion on the bill is not expected until after February 25. Any amendments, whether in committee or on the floor, could complicate final approval, requiring re-passage by the House.

You can follow the latest on the Sage Community Hub.

How to Get Help with Sage Fixed Assets 2024.1

Another benefit to this version is that it is now easier than ever for you to get fast, accurate help. The Sage Resource Centre is your one-stop shop for all things related to Sage Fixed Assets including the Community Hub, knowledgebase, learning materials, and more – and it is now conveniently located in the Help menu right inside your Sage Fixed Assets solution. You can find links to all the Sage Resources plus our own Sage Fixed Asset FAQ and more on our Paragon International Paracare page.

Of course, our team of fixed asset experts at Paragon are also happy to help you with anything you need, including remote upgrades.

Reach Out to Paragon for Help

Serving clients since 1985, Paragon International, Inc. provides independent, impartial and accurate cost segregation analyses, and property valuations and appraisals to assist in and support decisions related to taxes, risk management, investment, financing and corporate planning. Our consultants have extensive fixed asset experience – they’re fixed asset experts. Because of that we are able to offer a unique combination of irreplaceable human resources and advanced technology. We have specialists experienced in valuing closely-held securities, patents and other intangible assets, business enterprises, buildings, equipment and real estate. In addition, Paragon provides complete inventory and asset management services and solutions, including software customization and training, barcode labels and scanners, and tailored inventory services such as data conversion and integration, asset inventories, asset policies, cost reconciliation, and appraisal services. Contact Paragon International to discover how we can help you.