Cost Segregation Studies

It isn’t what companies make that counts,

it’s what they keep after taxes.

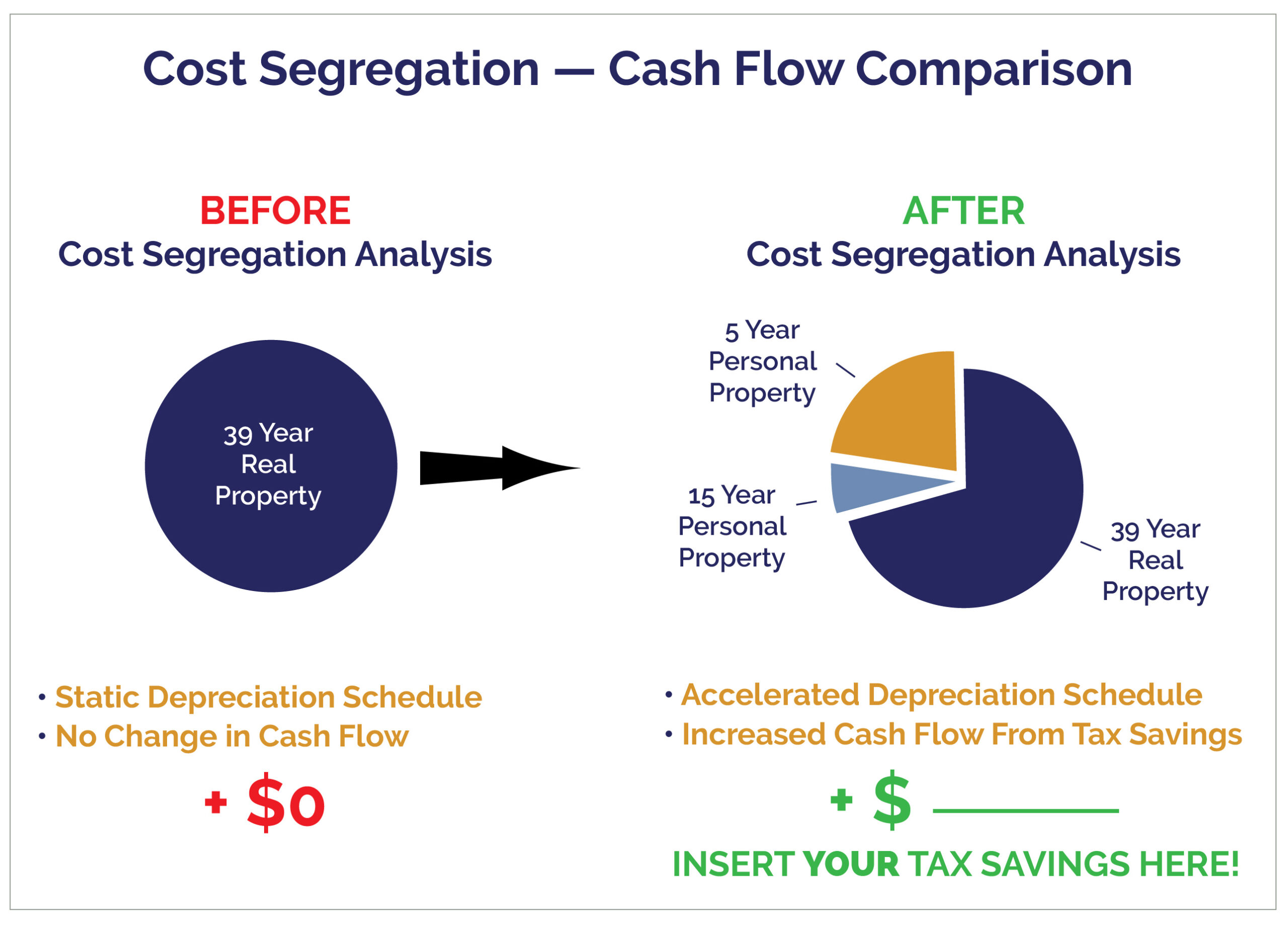

Cost segregation is an often overlooked tax strategy that can increase your cash flow immediately. By correctly reclassifying certain fixed assets as personal property instead of real property, you can accelerate depreciation and significantly reduce your tax liability.

How Does Cost Segregation Work?

Cost segregation is the process of identifying and separating construction-related personal property assets from real property assets and then calculating the correct depreciated value of those reclassified assets. This process can help companies and property owners save on taxes and boost cash flow, so you can reinvest into the property or issue distributions to shareholders.

To get started, companies or owners commission a cost segregation study performed by tax depreciation experts and engineers who understand how the IRS thinks about various assets and the “why” behind asset lifecycles. The study breaks apart critical operational elements from complex structural, mechanical, electrical, plumbing, and security elements within your building, as well as decorative elements. It then accurately reclassifies eligible elements as personal property or land improvements.

Real

Property

- 5- or 39-year straight-line depreciation

- Land and structures

Personal Property

- 5- or 7-year depreciation

- Items attached to a building or land, but not required for operation of the building, including:

- Decorative light fixtures

- Carpeting

- Window treatments

- Millwork

- Cabinetry

- Removable walls

- Office furniture

- Security systems

- Audio/visual equipment

- Telecommunications systems

Land Improvements

- 15-year depreciation

- Part of real property, but with faster depreciation allowed. Includes:

- Parking lots

- Sidewalks

- Fencing

- Landscaping

- Stormwater drainage

- Retaining walls

- Some signage

There is a reason the IRS has set up different depreciation times – they understand that certain items do not last very long. Since you are guaranteed to have to update your decorative elements, office furniture, and mechanical fixtures every few years, it does NOT make sense to straight-line depreciate certain improvements included with a building.

How Does Paragon Help You with Funding Sources?

Learn more about: Cash Flow Enhancement Services!

4 Kinds of Cost Segregation Studies

Which type of study is right for your needs?

New Construction Tax Engineering

Use this before new construction to optimize your tax benefits immediately.

Cost Segregation Study

Useful any time, but especially when new construction is completed and during or just after a building purchase to free up cash flow quickly.

Depreciation Look-Back Study

Recover overpaid taxes on buildings you’ve owned for years or if your last cost segregation study was accounting based.

Retirement Study for Renovation

Use before a renovation to claim extensive tax write-offs from discarded materials.

Success Story

When one of Paragon’s clients completed a major renovation of their large corporate headquarters, a previous accounting-based cost segregation study found a mere 12% of the $200 million cost as personal property. A few years later, Paragon’s engineering-based study found 28% as personal property. Without this study, the client would have missed out on a significant IRS refund.

Is Cost Segregation Right for You?

Some companies and property owners benefit from cost segregation, others do not.

Yes, if:

- You have a high-value property

- You plan to significantly improve a lower-value property

- You have substantial taxable income

- You have valuable equipment inside your building

- You are building a new property

- You are planning to purchase or already own a building

No, if:

- You have an existing net operating loss (you don’t need additional deductions)

- You plan to sell the property soon (ROI on the segregation study won’t be recouped)

- You have a residential rental property passive investment that is NOT earning a taxable profit yet (you can’t depreciate this until you earn a profit)

Trust the Experts at Paragon

We have in-depth fixed asset and tax depreciation experience and engineering expertise all in one team.

We identify ~8-15% more tax savings than accounting-based approaches.

We have a deep understanding of how to apply the IRS’s final Tangible Property Regulations (TPR) correctly and defensibly.

We focus on granular identification of the portions of your building’s systems eligible for accelerated depreciation.

Paragon’s Cost Segregation Study Process

Our comprehensive, end-to-end process leaves no stone unturned, giving you the information and documentation you need to maximize your tax write-offs and improve cash flow instantly.

We will:

- Identify often unknown and unreported IRS Tangible Property Regulations (TPR) Unit of Property (UoP) dispositions

- Measure the quantities and extent of the identified UoP components

- Conduct retrospective appraisals to determine the relative Fair Market Value of acquired components

- Apply TPR-designated and -approved valuation methodologies to reallocate the original basis

- Determine the accumulated depreciation through the current date

- Determine the current Net Book Value (NBV) tax basis for write-offs

- Create detailed work papers and IRS audit documentation as supporting evidence

Frequently Asked Questions

My accountant does my books for me, do I still need a cost segregation study?

We love working with our clients’ CPA and do so all the time. Together, we can be sure to get the maximum tax savings for you, our mutual client.

How much extra time will be required from me if Paragon's engaged for a cost segregation study?

What is the difference between an accounting-based cost segregation study and an engineering-based?

Additional Resources

The Latest on 179D Energy Tax Deductions

Big Changes Occurred to the 179D Energy Tax Deduction in January 2023 On Tuesday, August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law – one of the most sweeping climate bills ever created. The IRA is a massive piece of...

The 7 Benefits of Cost Segregation Studies

Why Cost Segregation Matters to Your Business Tax Day has come and gone, and you’re probably already thinking of how to reduce your business’ tax obligation next year. Cost Segregation is a valuable, often overlooked, tax strategy that can increase cash flow...

Discover How to Save on Your Tax Bill This Year by Following This Cost Segregation Real Estate Example

Understand the Step-by-Step Process to Get Your Immediate Tax Refund with this Cost Segregation Real Estate Example Many commercial property owners are overpaying on their taxes each year. Perhaps even you. If you are looking for a way to recoup prior overpaid...