Sage Fixed Assets – Depreciation

Sage Fixed Assets – Depreciation: The Complete Fixed Assets Solution

Gain the flexibility to manage your fixed asset lifecycles and calculate depreciation. Sage Fixed Assets – Depreciation provides advanced fixed asset accounting and reporting features for businesses needing effective decision making tools in integrated accounting environments. Chosen 3-to-1 over all competing solutions combined, Sage Fixed Assets is the right choice for your company.

- Most comprehensive depreciation calculation engine in the industry, containing over 300,000 IRS tax rules and GAAP supported depreciation methods

- Frequent software updates to keep you current with all the latest tax law changes. Read our blog for the latest updates.

- 20 depreciation books, all visible on one screen—Internal, Tax, ACE, AMT, State, and 15 user-defined custom books. Can use for many purposes such as state tax depreciation, property taxes, historical records, ADS depreciation, and more. Think of all the possibilities!

- Manage entire fixed asset lifecycles, including transfers and disposals

- Password security on user-defined menu levels

- Online help and electronic documentation

- Includes the Sage Fixed Assets – Depreciation Guide—an electronic version of the definitive resource on fixed asset management

- Bulk edit feature to update and recalculate large groups of assets for changes in tax depreciation methods

No more updating formulas in spreadsheets! Sage Fixed Assets – Depreciation automatically calculates AMT and ACE schedules and over 20 methods of depreciation – including MACRS 150% and 200% (formulas and tables), ACRS, Straight Line, Modified Straight Line (formulas and tables), Declining Balance, Sum-of-the-Years-Digits, and customized depreciation methods.

INTERESTED IN LEARNING MORE ABOUT SAGE FIXED ASSETS?

Learn more about Sage Fixed Assets – Depreciation

Watch the trailer!

Increase Productivity with Easy-to-Use, Customizable Features

- Fully customizable data entry screen including field names, field lengths, field pictures, and field prompts—fields can even be turned off completely

- Customizable Smart Lists for fast, accurate asset entry

- Powerful Group Manager for instant queries and reusable group definitions

- Group View for working with and viewing multiple assets simultaneously

- Tab Design lets you instantly switch between Main, Transfer, and Disposal functions

- Easy on-screen Help Icon with a click of the mouse

Want to go deeper with your fixed asset management? Combine with Sage Fixed Assets – Tracking to easily track and maintain your fixed asset inventory.

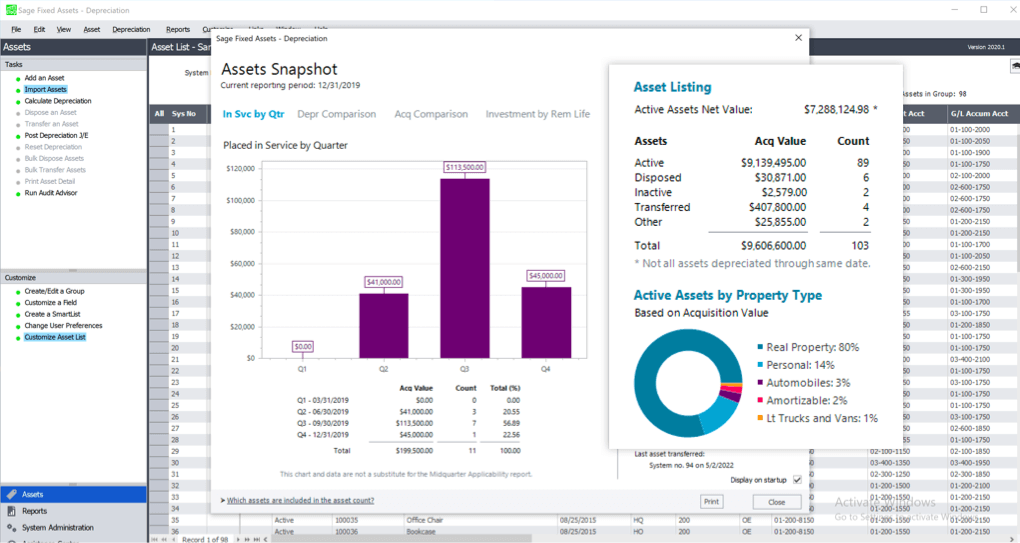

Sage Fixed Assets Depreciation Module Product Tour

Powerful Reports for All Levels of Management

Custom Report Writer provides graphics, drill down and batch reporting capabilities. Over 30 Powerful Reports come standard with Sage Fixed Assets – Depreciation, including:

- Allocation Percentage

- Annual Activity

- Annual Projection

- Asset Basis

- Capital Assets Notes Disclosure

- Change in Capital Assets

- Depreciation Adjustment

- Depreciation Expense

- Depreciation Summary

- Disposal/Partial Disposal

- Fixed Asset Summary

- General Ledger Posting

- Interest on Replacement Value

- Mid-quarter Applicability

- Monthly Projection

- Net Book Value

- Period Close Summary

- Property Tax—Summary and Detail

- Quarterly Acquisition

- Replacement Value

- Transfer/Partial Transfer

Sage Fixed Assets – Depreciation

Gain the flexibility to manage fixed-asset lifecycles and calculate depreciation. View the Sage Fixed Assets — Depreciation fact sheet for more information.